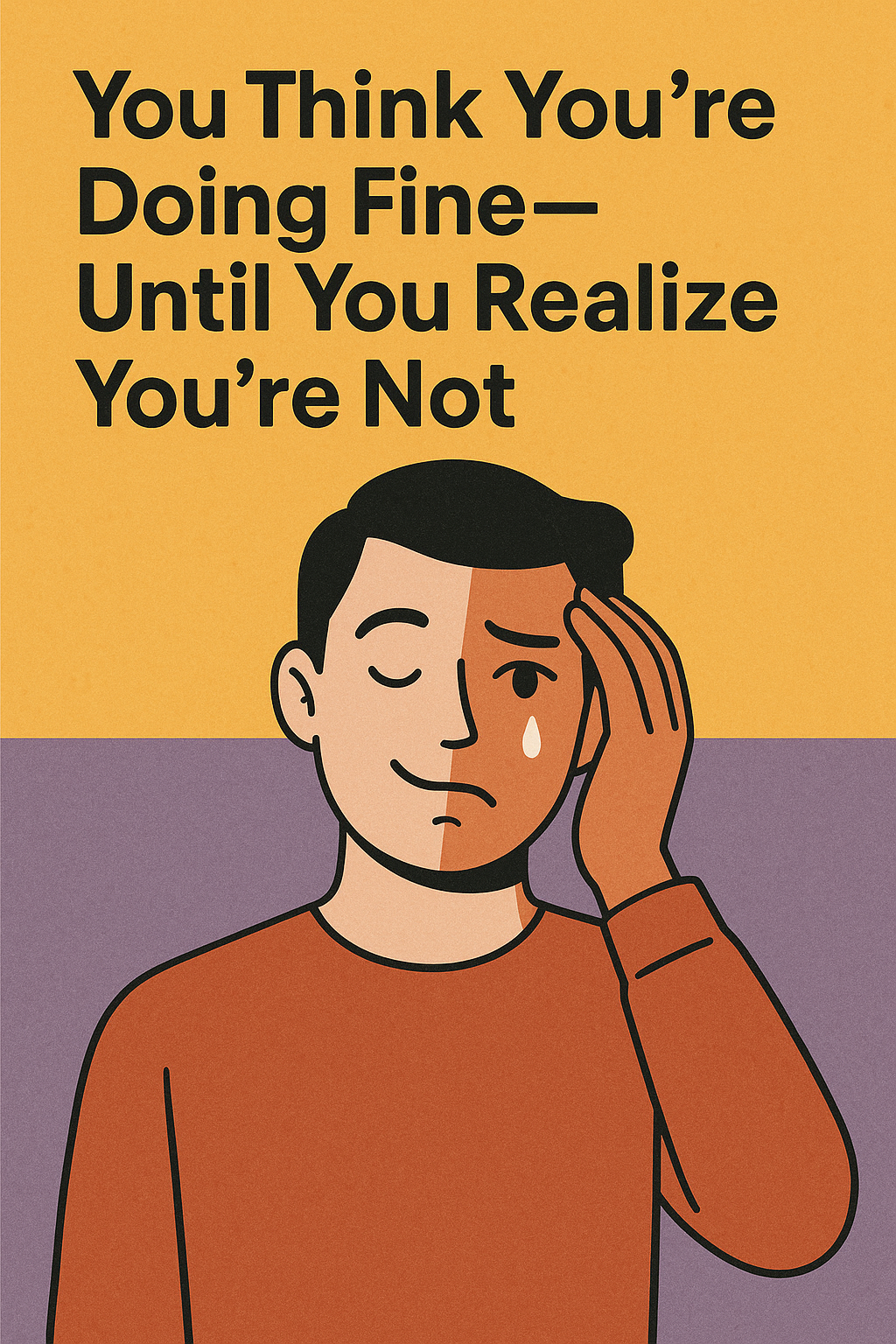

You Think You’re Doing Fine—Until You Realize You’re Not

This blog shares a personal journey from thinking you’re financially secure to realizing the dangers of conventional money habits. After a tragic loss exposed serious gaps—like lacking a will, life insurance, and a proper emergency fund—the author describes how outdated financial teachings (using credit cards for emergencies, accepting long-term mortgages, and minimal savings) left them vulnerable. By learning hard lessons about discipline and financial preparedness, they transformed their approach to money, emphasizing the importance of planning to protect loved ones and achieve true financial peace.

I thought we were doing fine. My wife and I were in our mid-30s, making good money, paying our bills, and living what we thought was a comfortable and responsible life. But in an instant, everything changed.

When my wife’s parents were killed in a car accident, the loss was devastating. Grief took over, and in the weeks and months that followed, we were forced to deal with the financial side of things- things we weren’t prepared for, things we didn’t even know we should have been prepared for. There was no updated will, no clear direction on what to do with their estate, and no roadmap for handling the responsibilities that suddenly fell on our shoulders. On top of that, my wife’s younger sister was still in college, and we had to figure out how to take care of her as well.

That was the moment we realized we had no idea what the hell we were doing.

We thought we had our stuff together and were being responsible, but the truth was, we weren’t nearly as prepared as we should have been. And the scariest part? We were living just like most people do—paying our bills, using credit cards, overextended on our mortgage, saving a little when we could, and assuming everything would work itself out. But if something had happened to one of us, our family would have been in a terrible position. We had no life insurance, no will, credit card debt, and a 100 percent mortgage and barely $1,000 in our savings account. If I would had lost my job, or gotten injured or worse, we would have been in serious trouble.

What We Were Taught About Money Was Wrong

It wasn’t our fault. It’s just how we were raised. Our parents taught us what they knew about money, just like their parents taught them. And for the most part, they followed the same financial path that so many others do.

We were taught that using credit cards was normal, as long as you paid them off each month. If an emergency came up, that’s what credit cards were for. Carrying a mortgage for 30 years was just part of life, and we never questioned it. If we had a car loan, that was fine, as long as we could afford the monthly payment. And saving? That was something you did when you could, after everything else was covered.

But when we were forced to handle a real-life crisis, we saw how flawed that thinking was. Debt wasn’t a tool—it was a weight. Credit cards weren’t an emergency fund- they were a financial trap. And living paycheck to paycheck while carrying a mortgage and other debts meant we were one disaster away from losing everything.

A Hard Lesson in Preparedness

That experience changed us. We realized that to truly protect our family, we needed to get serious about financial preparedness. We bought term life insurance, created a will, and started keeping detailed financial records, storing them all in one location. This way, if anything ever happened to one of us, the other wouldn’t be left scrambling. I recall my wife’s parents had statements scattered across their home; we’d find them in random junk drawers and cabinets, and there were many accounts they didn’t have records for. We literally found out about accounts they had years after their passing.

We also learned the importance of having a fully funded emergency fund. At the time, we had less than $1,000 in savings—barely enough to handle a small car repair, let alone a major life event. We committed to building an emergency fund of three to six months’ worth of expenses so that if life threw us a curveball, we wouldn’t be caught off guard.

But beyond the numbers, that season made us stop and think about what really mattered. When you lose people you love, you realize that money isn’t the goal—it’s just a tool. Our reason for saving and being prepared wasn’t just about security; it was about protecting and enhancing the things that meant the most to us.

We wanted the freedom to spend time with close friends and loved ones, to be actively involved in our children’s lives, and to create experiences and memories together. We didn’t want money—or the lack of it—to dictate our lives. That’s why we made a plan, got out of debt, and changed the way we handled money.

Discipline Is the Key to Freedom

Proverbs 5:23 says, “For lack of discipline they will die, led astray by their own great folly.”

That verse hit me hard. A lack of discipline with money won’t just make life stressful—it will destroy dreams, opportunities, and even futures. If we continued living the way we were, undisciplined and unprepared, we were setting ourselves and our family up for failure.

Getting out of debt wasn’t just about money; it was about peace of mind and being able to rest easy at night knowing that we didn’t owe anyone anything. It was about making sure that no matter what happened, our family wouldn’t be left struggling. But it didn’t happen overnight. It’s a long process that often isn’t pretty and is fraught with many sacrifices, often requiring us to say no to things that conflicted with our long-term hopes and dreams. This journey is not for the faint of heart and requires discipline and holding each other accountable. Once we realized our folly, it took discipline, sacrifice, and a willingness to change. It hasn’t been perfect, and we have made mistakes along the way. I’ll be the first to admit it; I have been challenged many times by the pressures of society and my own human weakness for more or better. But after we fall down, we get refocused and move forward, keeping what matters most as a driver to meet our goals.Because that’s the thing—building the life you want requires hard work. The financial freedom to live your dreams isn’t handed to you. You have to fight for it, plan for it, and be intentional every step of the way.

The Stark Reality: Statistics on Savings and Estate Planning

Our story isn’t unique. Many Americans find themselves unprepared for financial emergencies and lacking essential estate planning documents. Consider these statistics:

- Savings Shortfalls: A recent survey revealed that more than one in four Americans have savings below $1,000, with many attributing rising living costs as the reason for not saving more. ABA Banking Journal. $1,000 doesn’t get you much these days. I just had to replace a Jeep transmission about a year ago, and that was nearly $10,000! Standard practice is to save up to 3 to 5 months of expenses in the event of a job loss, but the current average time of unemployment is around 5 months….so you better start working on saving upward to 5 months of expenses. bls.gov

- Lack of Wills: Approximately 68% of Americans lack a valid will, leaving their families vulnerable to legal complications in the event of an unexpected death. MarketWatch+2Planned Giving Marketing+2MarketWatch+2 I’d be willing to bet of those 32% that have a Will, that nearly half of them are not up to date.

- Credit Card Debt: Approximately 46% of American households held credit card debt in 2022, indicating that nearly half of U.S. households carry a balance on their credit cards. Federal Reserve Bank of St. Louis. With rising costs of goods, I can only imagine this is going to increase.

- Mortgage Debt: As of March 2025, the average 30-year fixed mortgage rate is approximately 6.77%. Over the life of a $300,000 mortgage at this rate, a homeowner would pay an additional $395,000 in interest, effectively more than doubling the cost of the home. Let that sink in… you are paying more than double for your house? Does that make sense to you?

These numbers highlight a widespread issue: many are unprepared for the uncertainties of life, often due to misconceptions or procrastination. This supports the flawed thinking of the past. Given the uncertainty of the world economy today, why not try something different than what you have been doing?

What About You?

Take a moment and ask yourself: If something happened to me today, would my family be okay?

- Do you have a will in place?

- Do you have term life insurance to provide for your loved ones?

- Does your spouse know where to find important financial information?

- Do you have 3–6 months of expenses saved in case of an emergency or job loss?

- Are you debt-free, or are you one crisis away from financial disaster?

I wish someone had asked me these questions when I was younger. Instead, I had to learn the hard way. I challenged conventional thinking and chose to go against the norm. We’re not perfect, but we’re making progress. Now, we don’t lie awake at night stressing over bills. We have the freedom to make intentional choices with our money, rather than letting it control us.

I hope this inspires you to rethink the way you’ve always handled money—to challenge flawed thinking and try something different. Something that brings financial peace instead of stress.

Being prepared isn’t about paranoia—it’s about responsibility. It’s about making sure the people you love aren’t left scrambling to figure out your finances if something happens to you. Speaking from experience, you do not want to leave your family struggling to track down what you owned or guessing how you would have wanted them to handle it. The stress and guilt is overwhelming.

Don’t assume, “My spouse will get everything—they can deal with it.” In our case, both of my wife’s parents passed at the same time. Nothing was simple. If you’re not prepared, don’t wait until a tragedy forces you to realize it. Start today. Get life insurance, write a will, build an emergency fund, organize your finances, make a plan to get out of debt, and execute on it.

It’s the responsible thing to do and your family will thank you for it.

Want coaching?

Let’s connect, let’s build you up, let’s make you elite and let’s get you to believe in yourself!

Schedule a free financial coaching session here.

TJ is a financial coach that helps couples who earn good money but feel like they have nothing to show for it. They’re unsure about their financial situation and frustrated that they aren’t where they should be. He provides a path forward and helps them believe in themselves so they can get unstuck, gain confidence, take control and change their financial future.

Let’s chat—book a free call:

About the Author

TJ Recinella (Owner/ Founder of TJR Financial Coaching)

TJ helps couples who earn good money but feel like they have nothing to show for it. They’re unsure about their financial situation and frustrated that they aren’t where they should be. He provides a path to help them get unstuck, gain confidence, and change the financial future of their families.

.